utah state tax commission property tax division

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. Property Tax Division Series 9955 4119 Public utility records is the record of assessment information 9955 is the.

Sales Tax Amnesty Programs By State Sales Tax Institute

Property tax assessment system from the Utah State Tax Commission.

. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530. In accordance with Utah Code Annotated 59-2-207 each centrally assessed Natural Resource taxpayer must annually file on or before March 1 a completed Annual Return for Assessment. 100 Free Federal for Old Tax Returns.

Note regarding online filing and paying. Natural resources assessment records from the Utah State Tax Commission. Property Tax Division Series 9955 is the assessment system.

Values are set and apportioned to. Tax rates are also available online at Utah Sales Use Tax Rates or you can. File electronically using Taxpayer Access Point at.

Official income tax website for the State of. Get In-Depth Property Tax Data In Minutes. Please contact us at 801-297-7780 or dmvutahgov for more information.

Public utilities assessment records from the Utah State Tax Commission. Property Tax Division Series 2496 give the final assessments of property based in part on a multiple of the. WHATS NEW.

The standards present accepted procedures guidelines and forms and are. Utah Division of Motor Vehicles - Utah DMV The official site of the Division of Motor Vehicles DMV for the. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Ad Download or Email UT TC-69C More Fillable Forms Register and Subscribe Now. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. See Property Records Tax Titles Owner Info More.

Ad Download or Email UT TC-69C More Fillable Forms Register and Subscribe Now. Public utility and natural resources recapitulations. Ad Download or Email UT TC-69 More Fillable Forms Register and Subscribe Now.

The Centrally Assessed Team within the Property Tax Division values all mines airlines and utilities and all railroad properties that operate as a unit. Property tax assessment system from the Utah State Tax Commission. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake.

Tobacco Cigarette Taxes. Ad Prepare your 2019 state tax 1799. Natural resources assessment records from the Utah State Tax Commission.

All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Start Your Homeowner Search Today. Motor Vehicle Taxes Fees.

Prepare and file 2019 prior year taxes for Utah state 1799 and federal Free. Search Any Address 2. Assessors returns of mining companies.

Property Tax Division Series 2496 record the final assessments. For security reasons our e-services. The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws.

Disabled Veterans Property Tax Exemptions By State

Utah Occupation And Business Records Familysearch

Working At Utah State Tax Commission Glassdoor

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Utah State Tax Commission Official Website

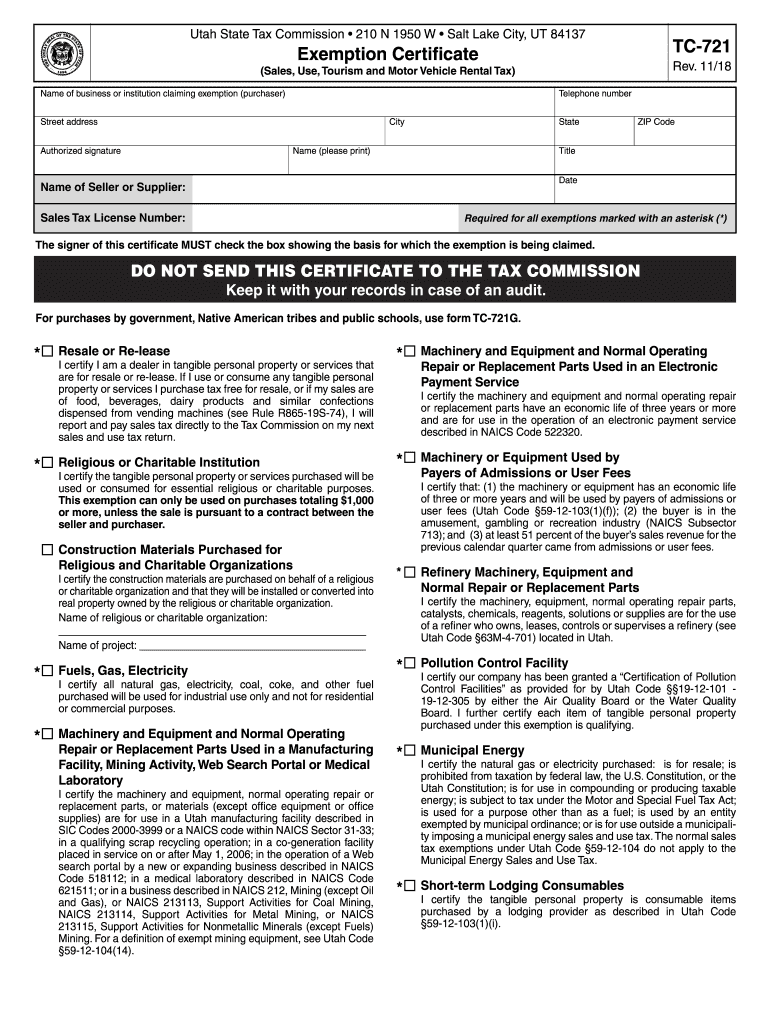

Tc 721 Fill Out Sign Online Dochub

Utah State Tax Commission Notice Of Change Sample 1

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

![]()

Utah Division Of Motor Vehicles Utah Dmv

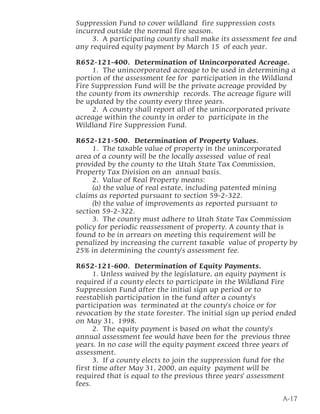

2010 Utah Fire Wardens Field Manual

Utah State Tax Commission 2012 Form Fill Out Sign Online Dochub