capital gains tax news in india

Capital gains tax in India Important rules to be aware of. Currently the Short Term Capital Gain tax is.

Capital Gains Tax Meaning Types Ltcg Stcg Tax Rates How To Save Tax On Capital Gains

If your ordinary tax rate is lower than the special rate ie either 10 12 22 or 24 your ordinary tax rate may apply to gain on.

. More than 12 months. Up to 1 Lakh is non-taxable. Suppose a property is sold after two years then he will have to pay Long Term Capital Gains tax.

10 tax on gains above 1 Lakh. On the sale of equity-based mutual fund units and equity shares. 10 over and above 1 lakh.

Net Sale Value. Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. The following percentage of tax deduction is available under such.

1 day agoFor 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly. If your Income is comprised of Capital gains that come. 2 days agoThe special rates are maximum rates.

After the GOP took up the cause in response to the inflation of the 1970s leaders in both parties agreed for years that the government. Suppose someone purchased a property for Rs 50 lakhs and sells it for Rs. Bloomberg Jan 22 2020 1448 IST Removal of the long-term capital gains tax and measures to boost consumption are high on equity investors wish list from the Union.

Major income tax changes in last 10 years and how they have impacted your investments. Cost of acquisition ie the purchase price of the capital asset Rs 132000. Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an.

Capital assets are investments like house land stocks mutual funds jewelry trademarks etcThe. 5 hours agoThis used to be nonpartisan wisdom. Cost of improvement ie post purchases capital.

From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. Long-term Capital Gains Tax. More than 36 months.

Debt-based mutual fund schemes. Zee News brings latest news from India and World on breaking news today news headlines politics business technology bollywood entertainment sports and others. 10 of capital gains.

The tax liability on such a type of transaction is 20 after indexation. It was announced that long. One of the changes announced was in April 2018.

In case the capital gains are long-term in nature one can claim exemption under Section 54 of the Income-tax Act 1961 if heshe invests the capital gains for purchase or. Inside the Plane Crash That. Capital gain is any profit or gain that occurs from the sale of a capital asset.

This guide tells you everything you need to know about capital gains and the tax applicable on it. Long Term Capital Gains Tax. Tax Breaks under section 80c to 80U is not available to Capital gain Income.

The Capital Gains Tax CGT depends on whether the gain was made quickly or over a long period. That threshold will rise about 7 to 44625 in 2023. On the sale of.

In that case the deposit will be viewed as an investment in capital gains bonds in India upon which tax exemption will be available under the Capital Gains Account Scheme 1988. Type of Capital Asset. Sunday October 16 2022 Breaking News.

12 hours agoFor instance in 2022 single taxpayers who earn below 41675 arent required to pay capital gains taxes on their investments. If the equity shares and equity-oriented mutual fund units are sold before 12 months of its acquisition then. Check out for the latest news on capital gains tax along with capital gains tax live news at Times of India.

Long Term Vs Short Term Capital Gains Tax

Starting May 1 Indonesia Will Impose A 0 1 Cryptocurrency Vat And Capital Gains Tax Coincu News

Tax Implications For Indian Residents Investing In The Us Stock Market

How To Calculate Long Term Capital Gain Tax On Equity Mutual Funds Youtube

Short Term Capital Gains Tax Rates For 2022 Smartasset

Realty Finance Articles Rera Rules Rera News Rera Compliances Rera In India Rera Calculator Where To Invest Best Money Saving Tips Capital Gains Tax

Cairn Liable To Pay Rs 10 247 Crore Capital Gains Tax Itat Nangia Andersen India Pvt Ltd

Dpiit Proposes Exemption Of Capital Gains Tax For Startups

Income Tax Slabs To Change In Budget 2020 Some Countries With No Income Tax

Selling Your Property Save Long Term Capital Gains Tax By Re Investing In The New One Businesstoday

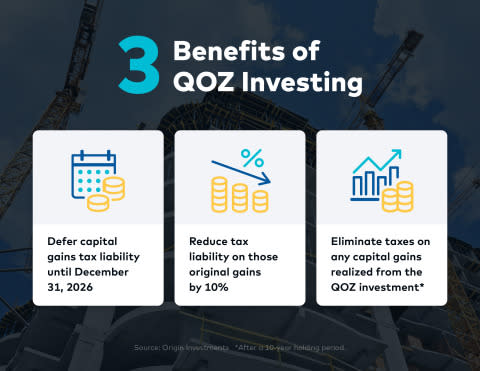

As December 31 Qoz Tax Benefit Deadline Looms Origin Investments Predicts Surge In Year End Real Estate Investing

Long Term Capital Gain Tax On Sale Of Property In India Sbnri

Govt Plans Reform In Capital Gains Tax Mint

/TermDefinitions_Capitalgain_finalv1-b039981b63214a4692683b5f10661a01.png)

Capital Gains Definition Rules Taxes And Asset Types

What Is Capital Gains Tax And When Are You Exempt Thestreet

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

How To Know If You Have To Pay Capital Gains Tax Experian

Ltcg Govt Starts Work To Bring Parity To Long Term Capital Gains Tax Laws The Economic Times